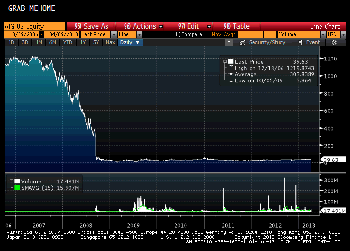

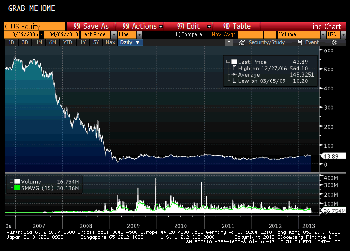

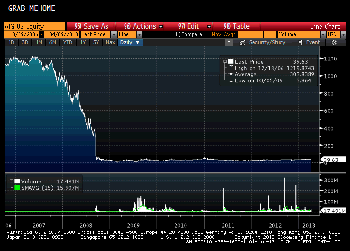

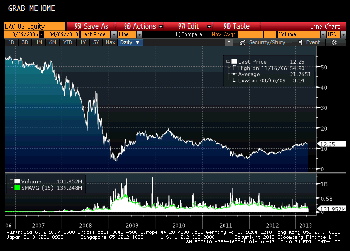

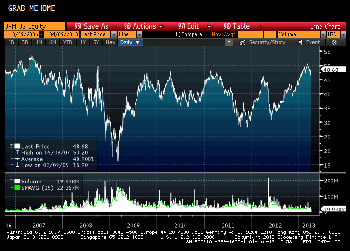

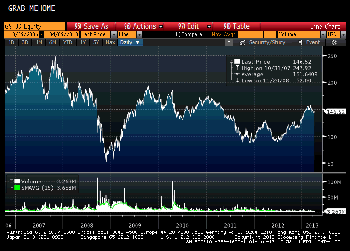

Here we see how the shareholders of AIG, Bank of

America, Citibank and Morgan Stanley did. As the charts

show, the shareholders lost at least 80% of their value. The

widespread perception that the investors were completely shielded

from the consequences of the risks they were taking is not borne

out by these charts:

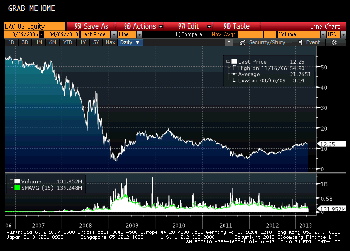

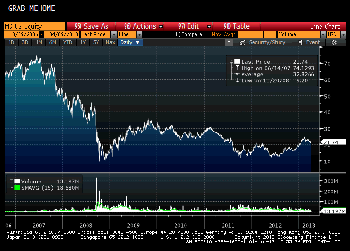

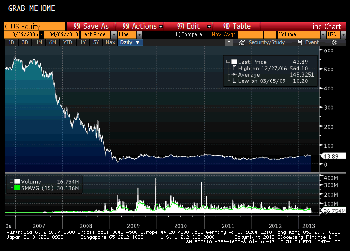

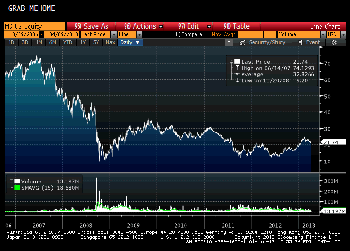

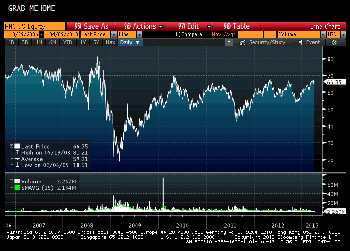

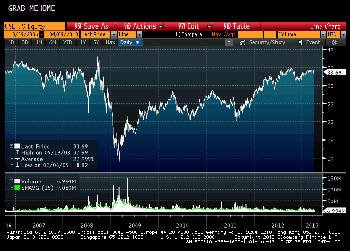

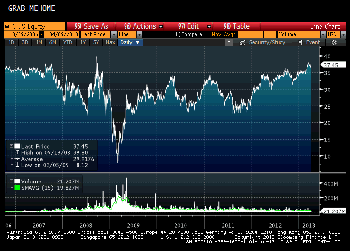

For these other five organizations, we see that

while the stock has recovered somewhat (though not entirely at

Goldman), stock price has not surpassed 2007 levels. The

geometric average increase in the price of any stock in the

S&P 500 is 7% per annum. However, the returns from

2007-2013 for the stock market in general has been flat -- so

these five financial organizations are neither falling behind

nor outperforming the rest of the stock market.